Leasehold homes in Vancouver can look like a great deal, but they come with important differences from freehold ownership. Here’s what to understand about how leaseholds work and what to watch for.

Leasehold homes in Vancouver can look like a great deal, but they come with important differences from freehold ownership. Here’s what to understand about how leaseholds work and what to watch for.Understanding Leasehold Properties in Vancouver

If you’ve been browsing Vancouver listings, you may have noticed some homes described as “leasehold.” These properties often appear more affordable than similar freehold homes — but they come with a few important differences worth understanding before you decide if they’re right for you.

What “Leasehold” Means

A leasehold property means you own the home, but not the land it sits on. The land is leased from another party — often the City of Vancouver, UBC, or a First Nation — for a set number of years, usually 50 to 99.During the lease term, you can live in the property, rent it out, or sell it. When the lease expires, ownership of the land and building returns to the landholder unless renewal terms are negotiated.

Why Leasehold Properties Exist

Leasehold arrangements are common where land is publicly or institutionally owned. Examples include UBC and SFU communities, certain City of Vancouver developments like False Creek South, and properties on Musqueam or Tsleil-Waututh land.

What Many Buyers Don’t Realize at First

Many buyers first notice leasehold homes because of the lower entry price, which often looks like an incredible deal compared to similar freehold condos. What buyers don’t realize is that the lower price is tied to the ownership structure. Leasehold means you own the home but not the land, and the value, financing, and resale all depend heavily on how many years remain on the lease. Some lenders won’t finance certain leasehold properties at all, and others require larger down payments or shorter amortization. Understanding this upfront helps buyers compare options confidently and avoid surprises later on.

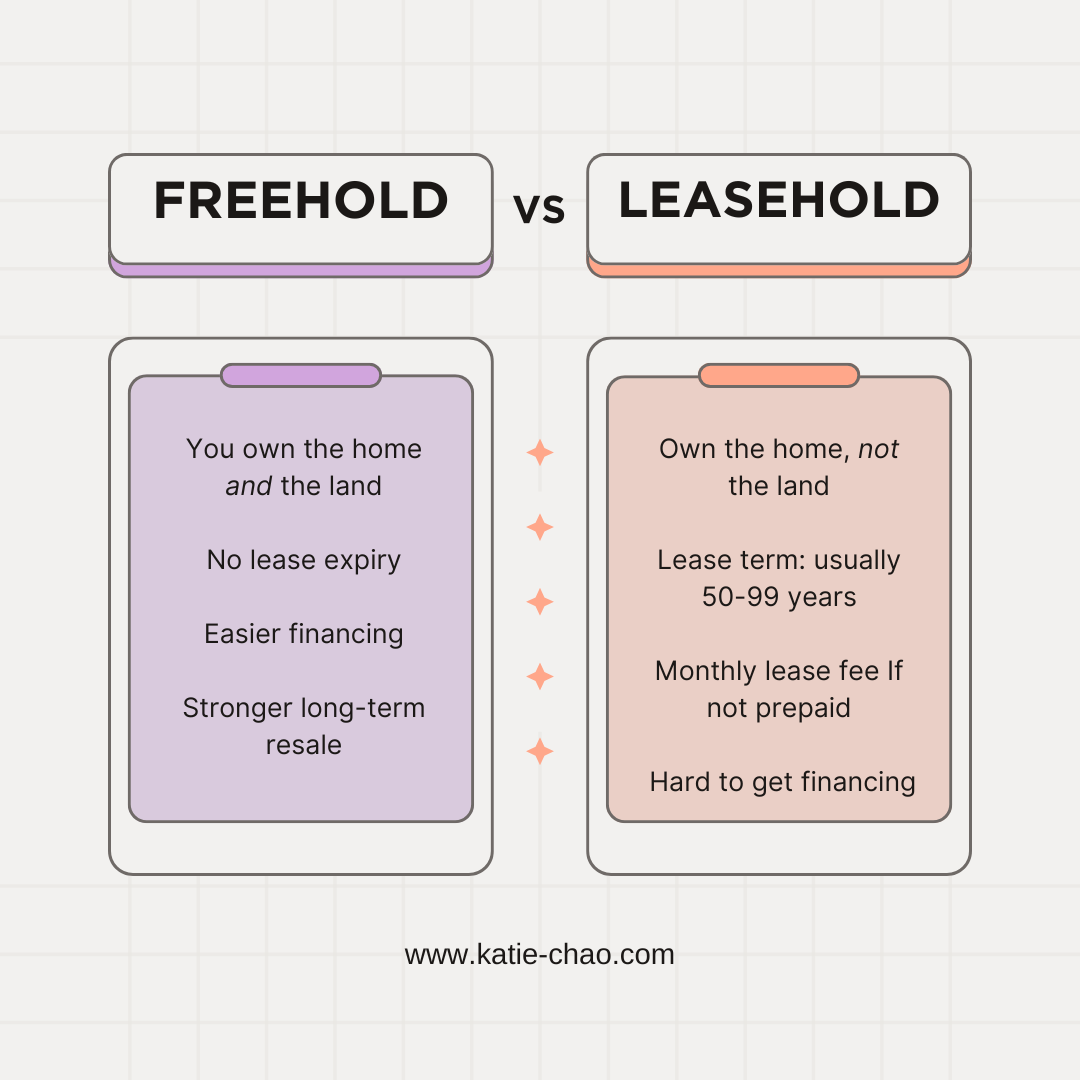

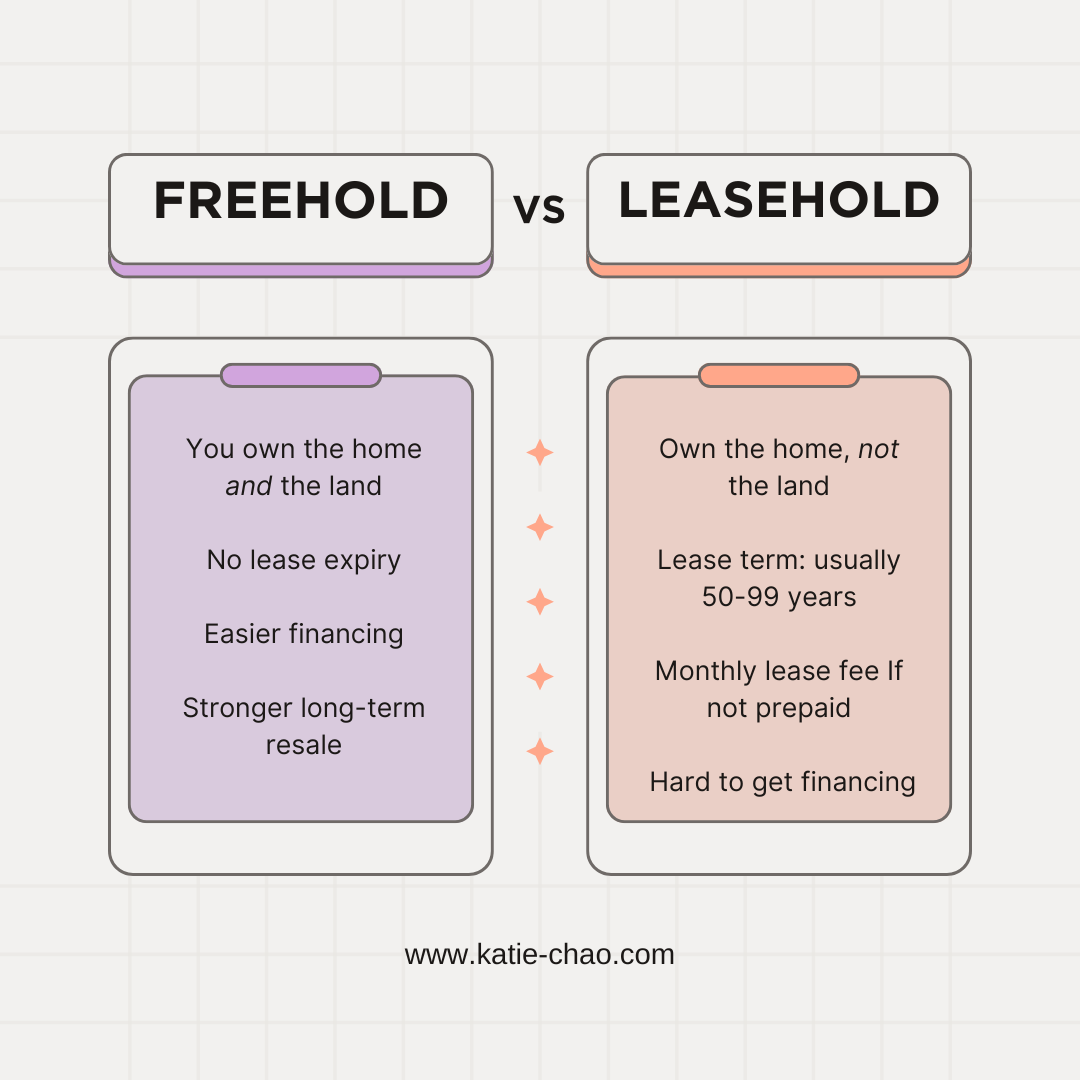

Here’s a simple side-by-side comparison to make the differences easy to see at a glance:

Not all lenders finance leasehold properties. Some restrict financing based on the lease term or land ownership. Even when financing is available, buyers may face stricter requirements.

Leaseholds can work for buyers who want a lower entry price, plan to live in the home for the medium term, prioritize location, and are comfortable with a different ownership structure.

Leasehold properties can offer excellent value and desirable locations, but they require a clear understanding of how the ownership structure works. Always review the remaining lease term, monthly lease payments, financing options, and renewal conditions before proceeding.If you’re exploring different ownership types or want help deciding whether leasehold or freehold fits your long-term plans, feel free to reach out — I’m always here to help you navigate confidently.

Key Things to Know

1. Affordability Advantage

Leasehold homes are typically priced lower than comparable freehold properties, making them appealing for buyers seeking a more affordable entry point.2. Lease Term Matters

The remaining years on the lease significantly affect the property’s value and financing. As the lease gets shorter — especially under 30 to 40 years — resale becomes more difficult.3. Monthly Lease Payments (If Not Prepaid)

Some leasehold properties require monthly lease payments to the landholder. If the lease is prepaid, these payments do not apply — but it’s important to confirm this.4. Financing and Resale

Not all lenders finance leasehold properties. Some restrict financing based on the lease term or land ownership. Even when financing is available, buyers may face stricter requirements.

Who Leasehold Homes Might Be Right For

Leaseholds can work for buyers who want a lower entry price, plan to live in the home for the medium term, prioritize location, and are comfortable with a different ownership structure.

The Bottom Line

Leasehold properties can offer excellent value and desirable locations, but they require a clear understanding of how the ownership structure works. Always review the remaining lease term, monthly lease payments, financing options, and renewal conditions before proceeding.If you’re exploring different ownership types or want help deciding whether leasehold or freehold fits your long-term plans, feel free to reach out — I’m always here to help you navigate confidently.

Disclaimer: The information shared in this post is provided for general educational purposes and should not be taken as legal, financial, or investment advice. Real estate details and regulations may change over time. Readers are encouraged to verify information independently and consult with qualified professionals before making any real estate decisions.

Written by Katie Chao, REALTOR® with eXp Realty.